Bonus Issue:

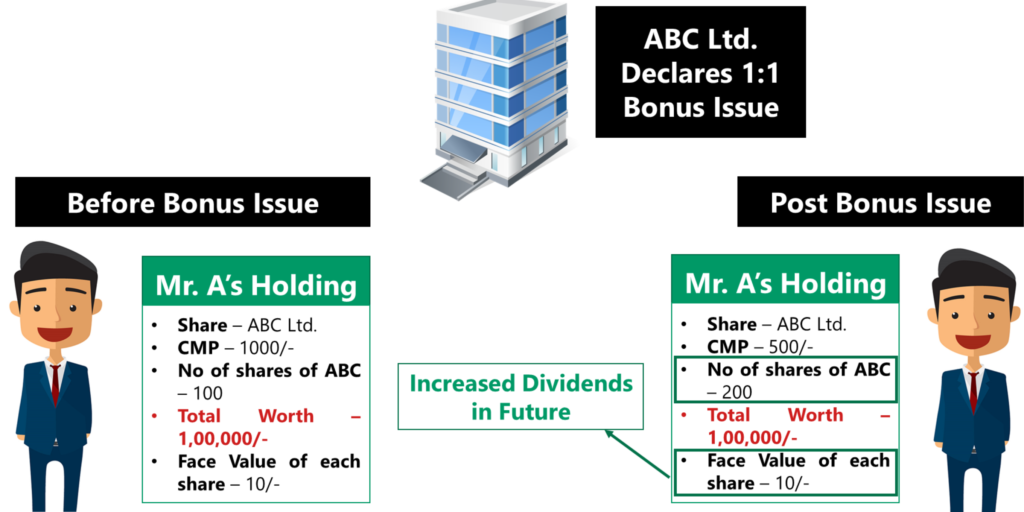

The company giving away free shares to current shareholders is known as a bonus issue. In lieu of paying dividends, a company may choose to distribute more shares. In a bonus issue, the number of shares rises while the investment’s value stays the same.

Key points regarding Bonus Issue:

- Bonus issue is made out of its reserves built from genuine profits.

- Face Value of the share remains same so shareholders get the benefit of increased dividends.

- Bonus issue are not taxable at the time of issue in the hands of the shareholders.

- Shareholder might have to pay tax if they sell the shares.

- Addition of outstanding shares decreases the stock price, making the stock more affordable for retail investors.

- The record date for the bonus share will be announced and all shareholders as on record date will be entitled to receive bonus.

- Bonus issue of 1:3 means that the shareholder will get 1 share for every 3 shares held i.e. if shareholder has 300 shares, then he will get 100 more shares.

Recent Bonus Issues

| Company Name | Ratio | Announcement Date | Record Date | Ex-Bonus Date |

|---|---|---|---|---|

| Indiamart Intermesh Ltd. | 1:1 | 28 Apr 2023 | 21 June 2023 | 21 June 2023 |

| Hardwyn | 1:3 | 26 Apr 2023 | 05 June 2023 | 05 June 2023 |

| Kenvi Jewels | 1:4 | 17 Mar 2023 | 19 May 2023 | 19 May 2023 |

| Veerkrupa Jewellers Limited | 2:3 | 09 Feb 2023 | 19 May 2023 | 19 May 2023 |

| Swaraj Suiting | 1:1 | 30 Mar 2023 | 19 May 2023 | 19 May 2023 |

| Varanium | 1:1 | 20 Mar 2023 | 12 May 2023 | 12 May 2023 |

| Sirca Paints India Limited | 1:1 | 29 Mar 2023 | 11 May 2023 | 11 May 2023 |

| Varanium Cloud Limited | 1:1 | 20 Mar 2023 | 09 May 2023 | 09 May 2023 |

| SRU Steels Limited | 1:2 | 10 Mar 2023 | 03 May 2023 | 03 May 2023 |

| Sprayking Agro | 2:3 | 16 Mar 2023 | 30 Apr 2023 | 28 Apr 2023 |

| Nettlinx | 1:1 | 06 Mar 2023 | 24 Apr 2023 | 24 Apr 2023 |

| IFL Enterprises | 1:4 | 09 Mar 2023 | 21 Apr 2023 | 21 Apr 2023 |

| Party Cruisers | 1:1 | 10 Mar 2023 | 18 Apr 2023 | 18 Apr 2023 |

| Innovana | 1:1 | 14 Feb 2023 | 30 Mar 2023 | 29 Mar 2023 |

| Achyut Healthcare | 1:2 | 18 Mar 2023 | 25 Apr 2023 | 25 Apr 2023 |

| Jet Infra | 1:1 | 09 Mar 2023 | 21 Apr 2023 | 21 Apr 2023 |

| Growington Vent | 24:100 | 17 Feb 2023 | 25 Mar 2023 | 24 Mar 2023 |

| Magellanic | 3:1 | 14 Mar 2023 | 22 Mar 2023 | 21 Mar 2023 |

| Global Cap Mkts | 1:1 | 27 Jan 2023 | 20 Mar 2023 | 20 Mar 2023 |

| Captain Pipes | 2:1 | 27 Jan 2023 | 03 Mar 2023 | 03 Mar 2023 |

| Jayant Infra | 2:1 | 20 Jan 2023 | 01 Mar 2023 | 01 Mar 2023 |

| Astral Ltd | 1:3 | 07 Feb 2023 | 14 Mar 2023 | 14 Mar 2023 |

| ASCOM | 1:2 | 20 Jan 2023 | 06 Mar 2023 | 06 Mar 2023 |

| 360 ONE WAM Ltd. | 1:1 | 19 Jan 2023 | 02 Mar 2023 | 02 Mar 2023 |

| Pulz Electronic | 1:1 | 23 Dec 2022 | 01 Mar 2023 | 01 Mar 2023 |

| Vinny Overseas | 13:10 | 16 Jan 2023 | 24 Feb 2023 | 24 Feb 2023 |

| Evans Electric Limited | 1:1 | 16 Dec 2022 | 10 Feb 2023 | 10 Feb 2023 |

| M K Protiens Ltd | 2:1 | 14 Nov 2022 | 03 Feb 2023 | 03 Feb 2023 |

| Goldstar Power Ltd. | 4:5 | 05 Dec 2022 | 21 Jan 2023 | 20 Jan 2023 |

| Music Broadcast | 1:10 | 22 Oct 2022 | 13 Jan 2023 | 13 Jan 2023 |

| Bombay Metrics | 3:1 | 11 Nov 2022 | 09 Jan 2023 | 09 Jan 2023 |

| Globe Commercials Limited | 1:1 | 14 Dec 2022 | 07 Jan 2023 | 06 Jan 2023 |

| Rama Steel Tubes | 4:1 | 18 Nov 2022 | 06 Jan 2023 | 06 Jan 2023 |

| G M Polyplast Limited | 6:1 | 14 Nov 2022 | 04 Jan 2023 | 04 Jan 2023 |

| Rhetan TMT Limited | 11:4 | 22 Dec 2022 | 10 Mar 2023 | 10 Mar 2023 |

| KPI Green Energy Ltd. | 1:1 | 12 Dec 2022 | 18 Jan 2023 | 18 Jan 2023 |